The healthcare construction market is expected to buck a sector-wide trend that has seen opportunities dwindle, spurred on by the creation of COVID-19 field hospitals and the announcement of a 14% rise in capital funding for the NHS in England.

A new report by construction market analyst, Glenigan, forecasts an 11% rise in healthcare project starts next year, and a 12% increase in 2022 as NHS trusts develop and implement their investment programmes as part of the Government’s Healthcare Infrastructure Plan (HIP).

The predictions come after the Government promised an extra £20billion for the NHS over the next five years, and announced 40 hospital projects that will press ahead over the next decade.

The 14% rise in capital funding takes the amount spent on the estate to £6.7billion for 2019/2020.

The Glenigan UK Construction Industry Forecast 2021-22 states that: “Initially frontline services, rather than longer-term investment in health facilities, will see the benefit of the additional resources.

“[But],while capital investment in NHS facilities can deliver efficiency improvements and better health outcomes; it will take time to bring forward new building projects.

“Encouragingly a weak development pipeline has begun to grow.

Initially frontline services, rather than longer-term investment in health facilities, will see the benefit of the additional resources

“Having declined for the last two years, the value of health projects securing detailed planning consent rose by 14% during the first nine months of 2020.

“The Nightingale temporary hospital programme has bolstered project-starts this year, helping to raise health starts by an estimated 11%.

“Looking ahead, the promised additional Government funding will begin to feed through to sector activity from next year.”

The report covers all construction sectors, with many having been hit hard as a result of the Coronavirus pandemic and the Brexit transition period.

It states that, in the ‘best-case scenario’, rapid adjustment to COVID-19 site working practices has enabled improved productivity and a faster recovery in output and project starts.

Growth in the value of underlying project starts by sector

And political flexibility will hopefully enable continued UK access to the single market while negotiations are completed on a more-comprehensive post-Brexit trade agreement.

But it also warns that weak growth and the disruption to UK business revenues and confidence due to Brexit and COVID-19 could deter private-sector investment in most non-residential sectors.

And reduced staffing levels on sites due to social distancing could also slow the pace of development activity and temper the progressive recovery in project starts across many sectors.

To address any potential problems, the report makes four key recommendations for the construction sector moving forwards.

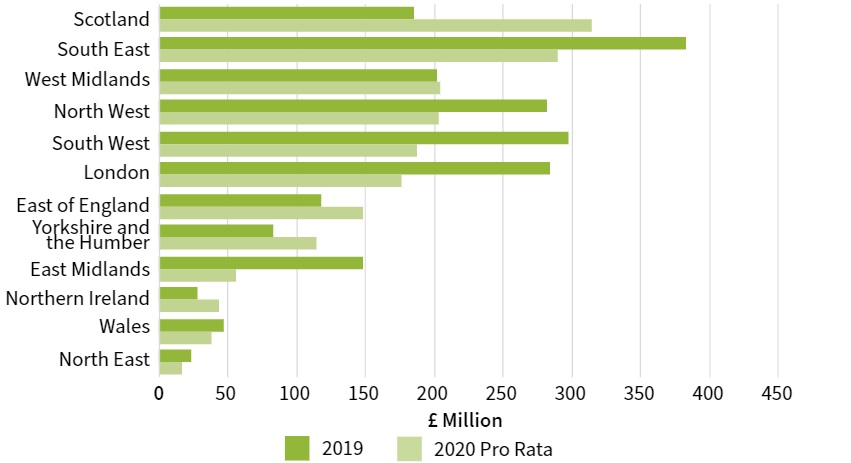

This table shows the value of underlying detail planning approvals for health projects by region

1. Target new areas of growth

Increased government funding will drive growth in the health sector. And, regionally, construction markets in the Northern half of the country are set to outperform London and the South East over the forecast period, reflecting a shift in Government funding.

And firms will need to target these new emerging opportunities, ensuring they have the expertise and resources to increase their exposure to growing markets.

2. Risk mitigation

COVID-19 working restrictions have reduced the number of personnel onsite and construction times are likely to be extended as a result, with implications for workload, turnover and cashflow.

The slow pace of site development will delay stage payments from clients and push back the timing of when late trades are required onsite.

Contractors and sub-contractors may, therefore, wish to offset the lower monthly revenues generated per site by spreading their workforce across a greater number of projects.

The report states: “A diversified client base will reduce exposure to any one client with a work pipeline spread more evenly over a larger number of customers.

“This can help reduce a business’s exposure to a financial crisis or adverse change of payment by any one firm.

“Simply relying on repeat business from an established set of clients will become an ever-more-risky strategy.

Supply chains should be reviewed to ensure firms are not over exposed to a few contractors or specialists and to identify any potential interruption of product supply

“Supply chains should also be reviewed to ensure that firms are similarly not over exposed to a few contractors or specialists and to identify any potential interruption of product supply, especially from overseas sources, due to the COVID-19 pandemic or new trading arrangements from January 2021.

3. Work more efficiently

Onsite working restrictions to contain COVID-19 transmission rates are currently exacerbating the need for the industry to use onsite labour more sparingly and effectively.

And, with the UK’s departure from the EU shrinking the pool of available skilled site labour; this will remain a priority as current restrictions are eased over the next two years and firms seek to expand their onsite workforce.

This threatens to increase construction costs and disrupt the timely delivery of projects.

The report encouraging companies to invest in design solutions, site operating practices, and offsite manufacturing options that reduce the reliance on site labour to safeguard the timely and profitable delivery of projects.

In many cases this will involve a more-collaborative approach and the use of digital solutions to cut waste and accelerate design and construction processes.

4. Digital opportunities

The pandemic has accelerated the adoption of digital systems, both pre construction and onsite, as more-traditional ways of working have been disrupted.

In the short-term, access to sites and arranging face-to-face contact is likely to be challenging.

But businesses which are early adopters of modern and proven digital sales and marketing tools are likely to emerge from the pandemic restrictions stronger, more efficient, and capture enhanced market share, says the report.

Also, investment in an effective CRM and a modernised salesforce will help firms to rapidly identify and target emerging opportunities, sustain their workload, improve efficiency, and enhance profitability.

Click here to access the full report.