The pressure to transform healthcare services so they deliver improved patient experience and outcomes is well recognised across the world. In this article, Chris Wilkinson, head of sales for healthcare and public sector at Siemens Financial Services (SFS), explores the ‘healthcare value indicator’ of systems worldwide and reviews research which estimates the ‘frozen capital’ from equipment and technology investments that could be released to fund operating requirements

Access to new-generation technology is often a real challenge for healthcare systems that are battling to contain and optimise operating costs and patient outcomes

Healthcare systems around the world are under pressure.

People are living longer, and healthcare systems are expected to deliver higher-quality healthcare to more people.

As a result, there is pressure to transform healthcare delivery so that it delivers improved patient experience and outcomes.

In response, policymakers and healthcare institutions are reviewing the efficiency and effectiveness of their healthcare resources, the pressure of demand on those resources, and the quality of the outcomes they deliver.

In Europe, healthcare systems which are publicly funded are under pressure to contain spending while improving patient outcomes – increasing both their efficiency and their effectiveness in creating healthier societies.

Healthcare funding is critical to alleviating the pressures of reform and development, yet there are limits on what the state can afford, or which taxpayers will agree to pay.

The proportion of Gross Domestic Product (GDP) spent on healthcare is a critical factor – as is the efficiency and effectiveness with which it is deployed.

And, as a result, healthcare finance managers are now looking to measure not only the efficiency of treatment procedures, but also the quality of patient outcomes resulting from that treatment.

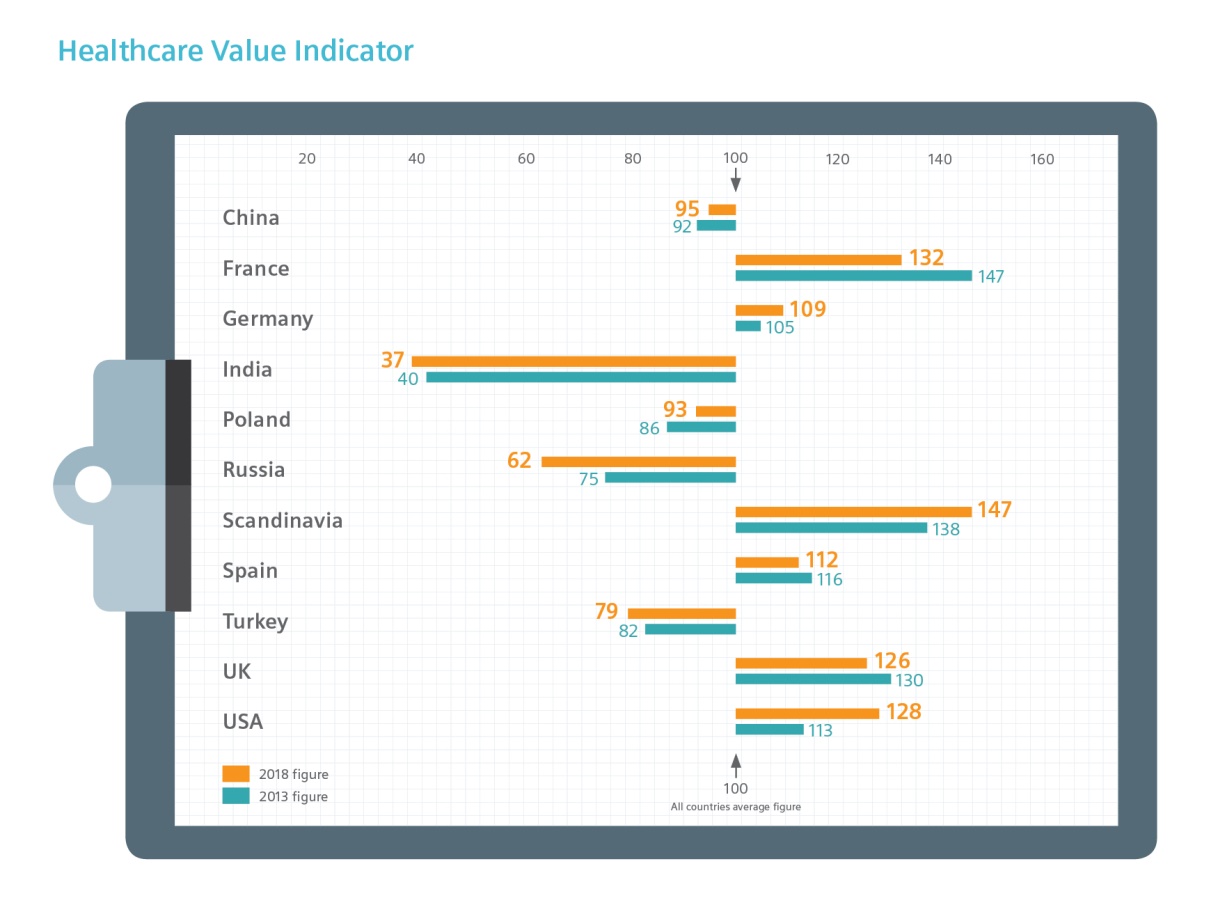

A new whitepaper from Siemens Financial Services, entitled Relieving the Pressure, looked at the net pressure on healthcare systems in 14 countries around the world and considered the relationship between healthcare demand and healthcare resources available. This was then related to the patient outcomes produced and the resulting ‘healthcare value indicator’ (the value that a health system is delivering) achieved.

The results show that France is currently delivering the best ‘healthcare value indicator’, closely followed by Scandinavia. Other European countries – UK, Germany and Spain – are delivering above-average indicator values.

Healthcare institutions worldwide now have the opportunity to examine levels of frozen capital and explore how much might be unlocked to enable the quest for improved patient outcomes and healthcare value

It is widely acknowledged that access to the latest technology and equipment – increasingly digitalised equipment – helps to improve patient outcomes.

Up-to-date technology is one critical element that relieves pressure on healthcare systems by optimising clinical and care skills.

Examples include super-precise surgical robotics, highly detailed medical imaging for earlier diagnosis, point-of-care diagnostics for more-rapid triage, laboratory automation to improve test turnaround times, automated dispensary to avoid medication errors, and telemedicine to improve access to healthcare.

Access to new-generation technology is, however, often a real challenge for healthcare systems that are battling to contain and optimise operating costs and patient outcomes.

As a result, healthcare systems around the world are increasingly looking to harness private-sector capital to fund at least a proportion of their capital requirements.

Using private finance can unlock ‘frozen’ capital – which would otherwise be tied up in capital equipment purchases, allowing it to be deployed on urgent operating requirements aimed at improving patient outcomes in the short-to-medium term.

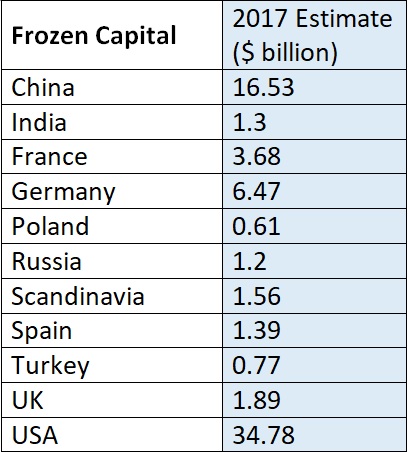

SFS has estimated the volume of capital finance that could be ‘unlocked’ from key equipment and technology capital investment and applied to urgent operating finance requirements as follows:

As a result, specialist technology finance solutions such as pay-for-outcomes technology upgrade and transition finance options are gaining increasing acceptance among healthcare institutions as a means of enabling cost-effective investments in new technologies.

Such financing solutions spread the cost of the technology over an agreed financing period, with finance payments arranged to align with the expected benefits of the use of the technology over time, such as improved operational efficiency.

Specialist technology finance solutions such as pay-for-outcomes technology upgrade and transition finance options are gaining increasing acceptance among healthcare institutions as a means of enabling cost-effective investments in new technologies

Such tailored financing packages tend to be offered by specialist healthcare financiers that have an indepth understanding of medical technology and its applications.

They understand the profound impact up-to-date technology can bring to the daily operation and can expertly evaluate any associated risks. They are, therefore, more inclined and more able to create customised financing packages that fit the specific requirements of each individual organisation – for instance, by flexing the financing period to suit the customer’s cashflow needs.

This contrasts with the standard financing terms usually available from generalist financiers who often lack technical expertise or a thorough understanding of the healthcare sector.

Healthcare institutions worldwide now have the opportunity to examine their own levels of frozen capital and explore how much might be unlocked to enable the quest for improved patient outcomes and healthcare value.