The volume of healthcare construction projects increased in February, despite overall activity showing a decline over the past two years, industry experts have revealed.

Barbour ABI’s March issue of its Economic Construction Market Review, showed that, across the construction industry as a whole, the value of building contracts awarded in February 2018 was £4.9billion, with London topping the regions with 24.8% of activity.

While the value of contract awards was down by 9.1%, following an unturn in January; the actual number of projects increased by 3.1% and was 3.4% ahead of February 2017.

The residential sector came out on top, with a 40% share of contract awards in February, followed by the commercial sector at 16% and retail at 14%.

And, while medical and health projects made up only 3% of overall activity; the number of contract awards increased by 17.3% in February this year, compared to January – standing at £148m – up by 15.7% on February 2017.

But, in three months to February 2018, the value of contracts was £375m – a decrease of 13.8% on the previous three-month period and 2.7% lower than the quarter ending February 2017.

While overall figures have been on upward trend since December 2017; values for February 2018 remain around 38% lower than in 2016.

In the medical and health sector, just one project appears in the overall construction top 10 – the £90m development of the Dovehouse Street extra care facility in Chelsea.

Awarded to Knight Build; it will deliver a 55-bed facility including a café, hairdressers and landscaping.

A smaller £17.5m mental health unit and inpatient facility is also proposed at St Ann’s Hospital in South Tottenham.

Awarded to Integrated Health Projects, a joint venture between Sir Robert McAlpine and Vinci; it will provide four new inpatient wards with a floorspace of 2,300sq m.

After London, the South East has the second-largest share of contract wins, including an £8.5m minor works programme for the Milton Keynes University Hospital NHS Trust.

The contract has been awarded to Galliford Try Construction Central under the Procure 22 programme and will see a series of improvements, refurbishments, reconfigurations and upgrades undertaken over a five-year period.

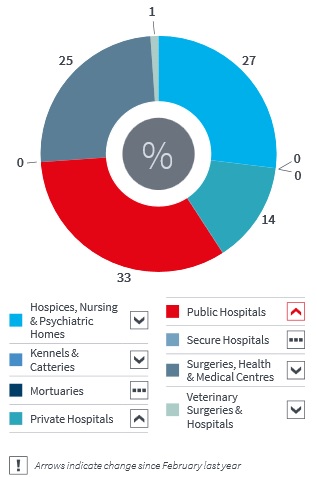

In terms of type of project, public hospitals accounted for the largest share of contract awards in February at 33%, an increase of 16% on February 2017.

Hospices, nursing and psychiatric homes were the second-largest sector with 27% of activity, which compares to 40% in February 2017.

This was closely followed by surgeries, health and medical centres with 25%, a 2% decrease on February 2017.

Most of the spending was in public hospitals