The Government’s decision to axe PFI is threatening to impact on the healthcare construction sector over the coming year, with a ‘positive’ pipeline being affected by ongoing Brexit talks and a switch from large-scale infrastructure developments to improvements in frontline service delivery.

Some extra funding schemes have been put in place by the current Government and could provide further impetus for capital injections to extend and improve existing facilities in the medium to longer term

According to Barbour ABI’s monthly Economic Construction Market Review, published this month, the value of total contract awards across all sectors declined by 13.1% in 2018, standing at £61.6billion.

And the number of contract awards continued on a downward trend to 10,352 in 2018, a decline of 8.2% on 2017.

Residential remained the largest sector, with the industrial sector also seeing upward movement, with a 21% increase year on year.

The report states: “The UK economy slowed in the second half of 2018, but with characteristics of an easing off, rather than a sudden stop as the UK begun the final manoeuvrings around the Brexit programme.

“Growth is forecast to be more subdued into the first half of 2019 against a background of low inflation, low interest rates, but indications of potential slowing of the global economy, particularly in terms of global trade and investment growth.”

The medical and healthcare sector saw a welcome recovery in 2018. But the report warns that the outlook for the next 12 months is more mixed.

It states: “Following two consecutive years of decline, medical and health contract award values turned positive in 2018, reaching £2.2billion. This is 64% higher than 2017, bringing values back to around the 2012 level and following a 43% decline between 2015-2017.”

Key to activity over the next 12 months will be the Government’s reaction to Brexit and the additional NHS funding promised following last year’s NHS 70th birthday celebrations.

“The sector is currently adjusting to the lower levels of investment in capital projects than in the early 2000s when PFI schemes for larger-scale hospital developments dominated health sector contract awards and output”, says the report

The focus of NHS budgets in recent years has been centred on improvement of services at the point of delivery and chronic disease prevention, rather than a large-scale building programme

“The planning pipeline remains positive, but operating at a significantly-lower level than some other construction sectors.

“The focus of NHS budgets in recent years has been centred on improvement of services at the point of delivery and chronic disease prevention, rather than a large-scale building programme.

“However, there are now critical aspects of NHS provision that are under sustained pressure, in particular A&E provision in some regions, and social care provisions on a national basis. Some extra funding schemes have been put in place by the current Government and could provide further impetus for capital injections to extend and improve existing facilities in the medium to longer term.”

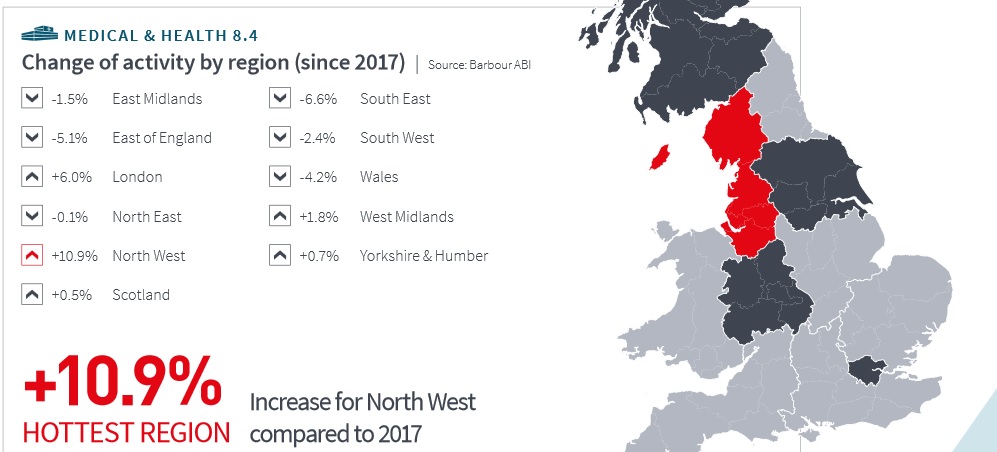

Within the health sector the North West was the largest region for contract values in 2018, at £626m, a 29% share.

The second-largest region was London, with 22%, while Scotland also saw a significant amount of activity, at 17% and worth £378m in 2018.

In terms of the pipeline moving forward, the report says: “Following a static year in 2017, the value of medical and health contracts achieving detail planning stage in 2018 improved by 39.3% in 2018 to reach £1.8billion. This good growth in 2018 perhaps signals a more-positive outlook, but values have remained below the £2billion threshold during the last four years.”

This graph shows how healthcare construction activity changed in 2018 compared to the previous year

The Top 10 2018

Top 10 CLIENTS for medical and healthcare construction projects January to December 2018

- Royal Liverpool and Broadgreen Hospital NHS Trust, 2 projects, value £341m

- Aneurin Bevan Health Board, 1 project, value £210m

- NHS Grampian, 2 projects, value £121m

- Hub North Scotland, 1 project, value £120m

- Milton Keynes University Hospital NHS Trust, 3 projects, value £93m

- The Department of Health, 6 projects, value £54m

- Heart of England NHS Foundation Trust, 1 project, value £45m

- Royal Brompton & Harefield NHS Trust, 1 project, £40m

- Nuffield Health, 1 project, £36m

- St Bartholomew’s Hospital, 1 project, £36m

Top 10 ARCHITECTS for medical and healthcare construction projects January to December 2018

- HKS Architects, 2 projects, value £355m

- NBBJ, 1 project, value £335m

- BDP, 2 projects, value £230m

- Norr, 1 project, value £120m

- Ryder Architecture, 3 projects, value £87m

- Oberlands Architects, 3 projects, value £68m

- The Design Buro (Coventry), 3 projects, value £49m

- IBI Group, 5 projects, value £48m

- Boyes Rees Architects, 3 projects, value £43m

- Scott Tallon Walker Architects, 1 project, value £36m

Top 10 CONTRACTORS for healthcare construction projects January to December 2018

- Kier construction, 21 projects, value £302m

- Laing O’Rourke, 1 project, value £210m

- John Graham Construction, 2 projects, value £124m

- Galliford Try, 2 projects, value £85m

- Interserve, 8 projects, value £58m

- BAM Construction, 6 awards, value £57m

- Integrated Health Projects, 5 awards, value £56m

- Willmott Dixon Construction, 5 awards, value £43m

- Robertson Group, 3 awards, value £38m

- Balfour Beatty Group, 1 award, value £34m

Top 10 medical and healthcare construction PROJECTS awarded in December 2018

- The Baird Family Hospital & The Anchor Centre (Scotland)

- Royal Cornwall Hospitals, Trelawney Wing extension (South West)

- Beechfield residential treatment centre (North West)

- Mockley Manor Nursing Home – extension and refurbishment (West Midlands

- Hull Royal Infirmary – MRI unit refurbishment (Yorks and Humber)

- Royal Stoke University Hospital – 5th Linac Decant Bunker (West Midlands)

- Buxton Road, Bosley – Treehouse Care Facility (North West)

- Worcester Royal Hospital – Aconbury North extension (West Midlands)

- Chippenham Community Hospital refurbishment (South West)

- Battersea Dogs & Cats Home – Arches 713-716 development (London)

All tables according to Barbour ABI’s Economic Construction Market Review, January 2019