The COVID-19 pandemic has offered a lifeline to the healthcare construction sector, providing immediate opportunities for design teams and contractors to aid in the delivery of emergency field hospitals and hospital expansion projects up and down the country.

But there are signs, according to experts, that the market is picking up outside of the current crisis, with the value of the development pipeline up 58% in the three months to March, before the coronavirus outbreak hit.

In addition, the value of detailed planning approvals was up 42% compared to the same period last year, according to new figures from industry analyst, Glenigan.

Across all construction sectors, the most-recent Glenigan Index reveals that activity remained subdued during the first quarter of 2020, with the value of projects starting on site averaging £5,063m per month during the three months to March, a 25% decline against a year ago.

March saw sites impacted by the coronavirus lockdown, cutting projects starts during the first quarter

The sharpest fall was in the value of major projects (of £100m or more), which at an average of £844m a month were at half the level of a year ago.

The value of underlying projects (under £100m) starting on site was little changed on the final quarter of 2019 on a seasonally-adjusted basis and 16% lower than a year ago.

Overall, the value of contract awards averaged £6,309m a month during the three months to March, a 9% fall on a year ago.

This fall was due the value of underlying contract awards dropping by 18% against a year ago.

In contrast, the value of major contract awards was 13% higher than a year earlier.

For April 2019 to March 2020, the Department of Health (DoH) was at the head of the league table for the top 50 clients, with 295 projects worth £1.46billion.

For the month of March 2020, the DoH was second in the league table with 34 projects worth £172m.

Commenting on the arrival of the coronavirus pandemic in the UK, the report states: “March saw sites impacted by the coronavirus lockdown, cutting projects starts during the first quarter.

“And a more-significant downturn in project starts is expected in next month’s Index as the lockdown continues to disrupt starts during April.”

It adds: “COVID-19 restrictions around the world had a noticeable impact on manufacturers’ supply chains during March.

“Vendor delivery times lengthened to the greatest extent in the survey’s 28-year history amid reports of input, shortages, transport disruption and delays in receiving goods from overseas.

“Manufacturers also reported that disruption resulting from the COVID-19 outbreak, lower market confidence, and company shutdowns had all contributed to the drops in production and new business.”

Also tracking activity in the market is Barbour ABI, which has released its Economic Construction Review for April.

This reveals that the value of medical and health contract awards in March was £118m based on a three-month rolling average. This is 8.0% lower than February and also 32.8% lower than March 2019.

Due to the COVID-19 outbreak vendor delivery times lengthened to the greatest extent in the survey’s 28-year history amid reports of input, shortages, transport disruption and delays in receiving goods from overseas

Quarterly analysis shows that in the first three months of 2020, the total value of medical and health contract awards was £341m; 28.5% higher than Q4 2019, but 21.1% lower than for Q1 2019.

The focus for current contract awards is for smaller-scale extension and refurbishment projects.

However, according to the report, the COVID-19 outbreak has seen a number of contract awards for the conversion of facilities to serve as emergency hospital facilities which could boost output growth in the short-term.

The region attracting the largest share of contract awards in March was the South West, with attributable share of 21.4%.

The largest contract award in the region in March was the £6m Musgrove Park Hospital Phase 2 – Sterile Services Department.

Awarded to Kier Western, this 48-month project involves the refurbishment and extension of the existing department to provide a total floor area of 9,750sq m within a three-storey structure.

Scotland was the second-largest region this month, attracting 20% of awards.

Public hospitals had the largest share of contract awards in March, although the figures were 11.7% lower than the same month last year

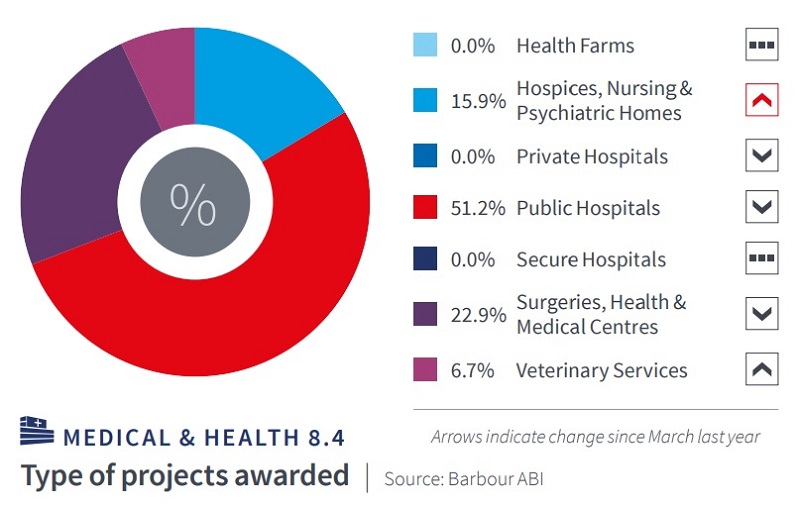

Analysis by sector shows that public hospitals had the largest share of contract awards in March at 51.2%, but this is 11.7% lower than for March 2019.

Surgeries, health and medical centres were the second-largest sector, accounting for 22.9% of awards, a decrease of 10.3% on a year ago.

The third largest sector was hospices, nursing and psychiatric homes, accounting for 15.9% of awards, which compares to just 2.4% share of awards in March 2019.

Top clients for the period of April 2019 to March this year were Sandwell and Birmingham Hospital NHS Trust with two projects worth £271m; and South West London and St George’s NHS Trust, with two projects worth £74m.

The most-active architectural firms in the sector were Stride Treglown, with nine awards worth £287m; and Ryder Architecture, with four awards worth £93m; while Balfour Beatty and BAM Construction top the contractor table with six awards worth £327m and seven awards at £153m respectively.